Start Here!

workshops & Webinars

Learn, Grow, and Take Control of Your Financial Future

Lessons For Life(And Death):

Build Your Legacy With Life Insurance

A quick video breakdown on why life insurance matters—and why it’s essential to have it today.

TESTIMONIALS

What others are saying

"The Policies Build Cash Over Time"

"I wanted to take a moment to share my experience and express my gratitude. Recently, I was having a conversation with Angela about family, when she brought up the importance of protecting not only my loved ones but also my assets and legacy. That really struck a chord with me.

She took the time to explain different types of coverage tailored to my situation: my age (over 60), my health, my business, my income, and my overall assets. Together, we found the policy that made the most sense for me."

-Lorita

"A Pleasurable Experience"

"It was a pleasurable and enlightening experience with agent Angela Brown in obtaining insurance policies for my grandchildren. What a marvelous joyful and knowledgeable individual with a caring heart."

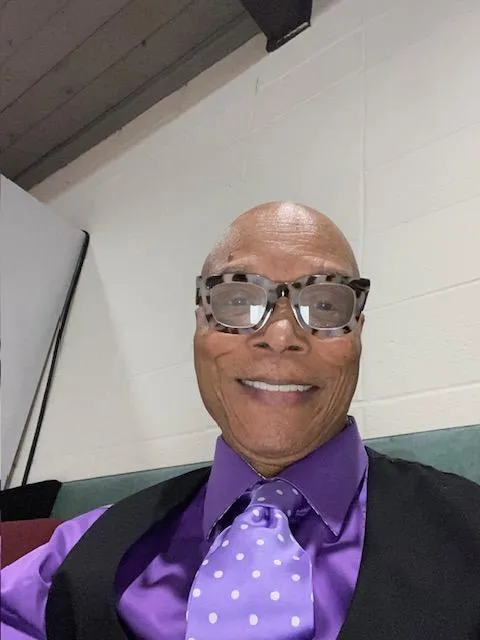

- James

"The Best Decision I Have Ever Made"

"I never realized how much peace of mind a life insurance policy could bring until I got mine. Knowing that my family will be financially secure no matter what happens has lifted such a huge weight off my shoulders. The process was simple, transparent, and the customer service was beyond helpful every step of the way. I can honestly say it’s one of the best decisions I’ve ever made for my loved ones."

-Jame'sa

Our Trusted Partners

Join The Conversation On Our Blogs!

Our blog is more than just articles—it’s a place to explore ideas, learn practical strategies, and connect with a community of families and individuals focused on building financial security and lasting legacies. We encourage you to read, comment, and share your thoughts, questions, or experiences. Your engagement helps create a richer conversation and empowers everyone to take informed steps toward their financial goals.

Bouncing Back After a Financial Setback: How to Rebuild After Tapping Into Your Savings

Bouncing Back After a Financial Setback: How to Rebuild After Tapping Into Your Savings

The Reality

Life happens. Between job losses, rising costs, or unexpected emergencies, tapping into your savings can feel like a setback — but it doesn’t have to define your financial future.

At Hozana Wealth Legacy, we believe that every challenge is just a setup for a stronger comeback.

The Rebuild Plan

Rebuilding your finances after dipping into savings starts with clarity and consistency. You don’t need to have it all figured out right away — you just need a plan that works for you.

Assess, Don’t Stress: Take a full look at your current financial picture — what you have, what’s owed, and what needs to change.

Refocus on Priorities: Identify essential expenses and create small, attainable savings goals.

Automate Your Comeback: Set up automatic transfers to rebuild savings or investments — consistency creates confidence.

Protect Before You Prosper: Secure your foundation with insurance tools like income protection, living benefits, and emergency reserves.

Your Bounce-Back Checklist

Use this checklist as your step-by-step guide to getting back on track — one smart decision at a time.

Step 1: Financial Assessment

Review your current bank and savings balances.

List all monthly expenses and identify unnecessary spending.

Check your credit report for accuracy.

Set a realistic short-term financial goal (30–60 days).

Step 2: Income Recovery

Explore new or additional income sources (freelance, side gigs, remote work).

Check eligibility for unemployment, assistance, or relief programs.

Review your resume or LinkedIn profile for opportunities.

Step 3: Savings Rebuild

Open or reestablish your emergency savings account.

Automate weekly or bi-weekly deposits — even small ones.

Rebuild with purpose: divide savings into “emergency,” “future goals,” and “retirement.”

Track progress monthly to stay motivated.

Step 4: Protection & Planning

Review your insurance coverage (life, health, income, mortgage).

Consider protection plans that cover job loss or disability.

Schedule a financial strategy session with an advisor to discuss future safeguards.

Step 5: Growth & Confidence

Set long-term goals for financial stability and wealth creation.

Educate yourself with financial podcasts, blogs, and guides.

Celebrate small wins — they build momentum.

Stay connected with a financial coach or advisor for accountability.

The Mindset

Bouncing back isn’t about how fast you recover — it’s about how strong you come back. Every deposit, every payment, and every plan you make is proof of progress.

The key is not perfection — it’s persistence.

Ready to rebuild your savings with confidence and strategy?

Schedule a complimentary consultation with Hozana Wealth Legacy today and let’s design a personalized bounce-back plan that puts your financial goals back in motion.

#FinancialRecovery #SavingsPlan #BounceBack #MoneyMindset #WealthLegacy #FinancialWellness #RebuildingWealth #SmartMoneyMoves #FinancialResilience

Follow Us On Social Media

Join Our Exclusive Community!

Join our community and unlock additional tools and guidance

FAQs

What services does Hozana Wealth Legacy offer?

Hozana Wealth Legacy provides a wide range of financial and insurance solutions, including tax-free retirement planning, life insurance, mortgage protection, college savings plans, debt elimination strategies, and wealth-building consultations.

Our mission is to help individuals, families, and small business owners protect their income, preserve their legacy, and achieve long-term financial independence.

Is Hozana Wealth Legacy affiliated with a specific insurance company?

Hozana Wealth Legacy works with a network of trusted insurance and financial partners to ensure clients get access to the best options and rates available.

Our advisors act in your best interest — ensuring transparency, flexibility, and protection for every policyholder.

How do I know which financial plan is right for me?

That’s exactly what our consultations are for!

We take time to understand your current financial stage, family situation, and long-term goals before recommending any plan.

Whether it’s life insurance, tax-free retirement, or debt elimination, our approach is personalized, not one-size-fits-all.

How can I get started?

Getting started is simple:

Book your free consultation through our website.

We’ll assess your needs and goals.

You’ll receive a clear, step-by-step strategy to protect your finances and build lasting wealth.

Your journey toward financial freedom and peace of mind begins with one conversation.

Why the name “Hozana Wealth Legacy”?

The name Hozana symbolizes faith, purpose, and gratitude — the foundation of every legacy we help our clients build.

Our mission is to help you transform your income into impact, so your family’s story — and success — lives on for generations.

COMPANY

LEGAL

© Copyright 2025. Hozana Wealth Legacy All Rights Reserved.